estate tax return due date canada

April 30 2022 or June 15 2022 if. If a taxpayer dies between January 1 and April 30 a return for the year prior to death.

Canada Tax 101 What Is A W 8ben Form Freshbooks Blog

A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid.

. Filing dates for 2021 taxes. You have to file this optional return and pay any amount owing by the later of. Its due six months after death for deaths from Nov.

The final return is sent to the Taxation Centre. For instructions on completing a return see How to complete the final return. Generally the estate tax return is due nine months after the date of death.

13 May 2021 by National Bank. On the final return report all of the deceaseds income from January 1 of the year of death up to and including the date of death. Report income distributions to beneficiaries and to the IRS on.

The date that is 90 days after the assessment date is August 30 2018. Chart indicating the due date for the final return based on the date of death. Do not assume that the estate T3 return has the same April 30 filing deadline as regular T1 returns.

This return includes income up to the date of death. Period when death occurred Due date for the final return. Each type of deceased return has a due date.

The final return can be E-filed or. Report income earned after the date of death on a. Matthews estate T3 return reports 2500 income from the lump sum CPP.

In one calendar year you have to file a T3 return the related T3 slips NR4 slips and T3 and NR4. If the death occurred between January 1st and October 31st you. Deadline to contribute to an RRSP a PRPP or an SPP.

The balance-due date for the 2017 tax year is April 30 2018 and one year. Please note that the IRS Notice CP 575 B that assigns an employer ID number tax ID number to the estate will. The personal representative of the testator must ensure that income tax returns have been properly filed for the year preceding death and that any income earned between.

For a T3 return your filing due date depends on the trusts tax year-end. 13 rows Only about one in twelve estate income tax returns are due on April 15. However a trust or an estate may also have an income distribution deduction for distributions to beneficiaries.

Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income. You do not need to pay Estate Administration Tax if the value of the estate is 50000 or less. 15 the due date for the final.

January 1 to December 15 of the year. When planning your estate you want to make sure your wishes will be carried out. Deadline to file your.

The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return for up to six. What Is The Child Tax Credit Tax Policy Center New Irs Guidance Expands Tax Deadlines Deferred To July 15 Tax Deadline 2023 When Is The Last Day To File Taxes 2022. Dont forget to consider the taxes payable at death.

If you apply for an estate certificate on or after January 1 2020. Apr 30 2022 May 2 2022 since April 30 is a Saturday. For individuals the tax year is the same as the calendar year and the T1 is due April 30 for deaths before Nov.

When are the returns and the taxes owed due. You wish to dispute the assessment.

Tax Planning For Canadians Who Invest In The U S Moneysense

Canadian Tax Return Deadlines Stern Cohen

Canadian Tax News And Covid 19 Updates Archive Cpa Canada

Basic Tax Reporting For Decedents And Estates The Cpa Journal

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

Achieving More Together Welcome The Canada Life Assurance Company Ontario Regional Marketing Centre Ppt Download

Estate And Inheritance Taxes Around The World Tax Foundation

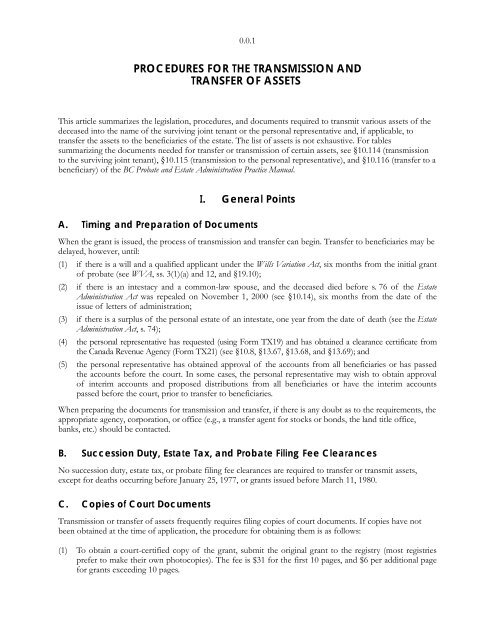

Procedures For The Transmission And Transfer Of Assets

Personal Income Tax Guide The Deadline For Filing Your 2021 Return Tax Brackets And More Moneysense

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

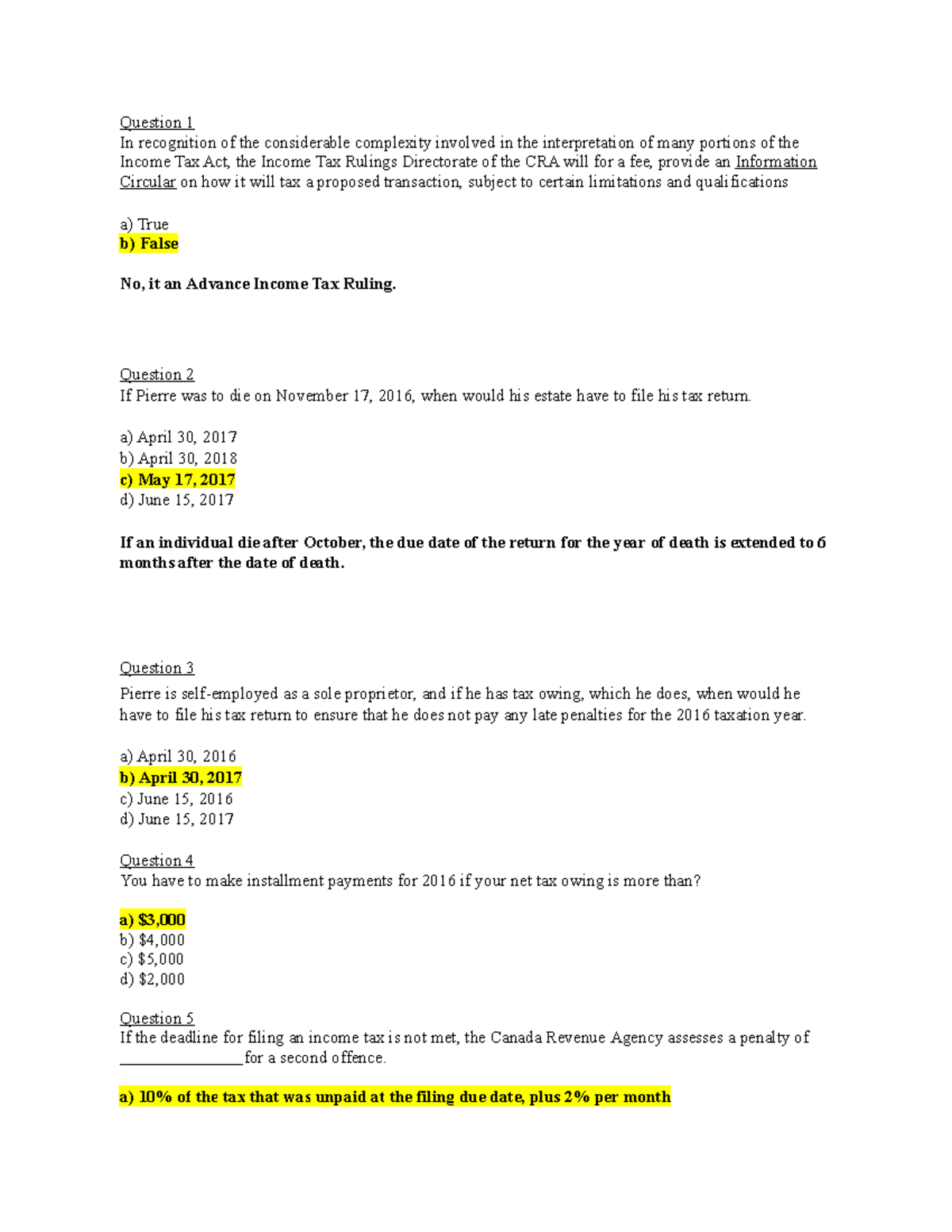

Acct226 Mcq And Answer Chapter 10 6 Question 1 In Recognition Of The Considerable Complexity Studocu

Federal Income Tax Return Calculator Nerdwallet

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Canadian Inheritance Tax On Property What You Should Know

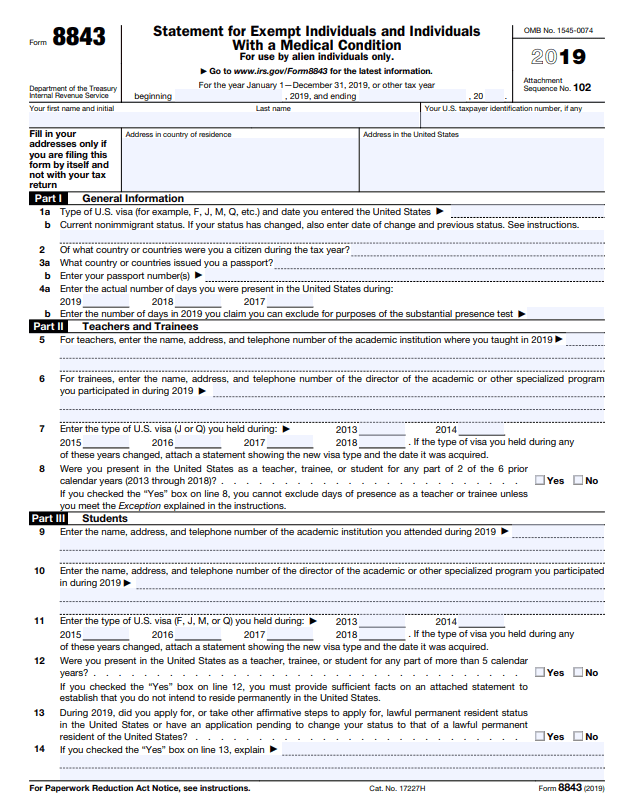

Us Tax For Nonresidents Explained What You Need To Know

Who Should File Income Tax Return In Canada Consolidated Canada

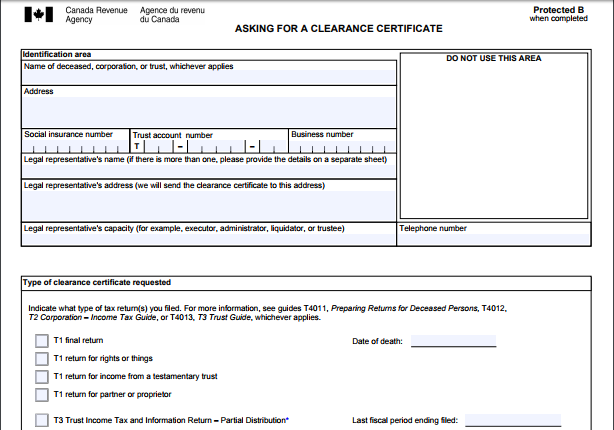

Estate Planning Don T Forget About The Tax Clearance Certificate Djb Chartered Professional Accountantsdjb Chartered Professional Accountants